unemployment tax refund 2021 calculator

This amount minus your deductions is used. Then get Your Personal Refund Anticipation Date before you Prepare and e-File your 2021 IRS.

H R Block Tax Calculator Services

COVID Tax Tip 2021-46 April 8 2021 However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

. Estimate the areas of your tax return where needed. This handy online tax refund. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021.

This is only applicable only if the two of you made at least 10200 off of unemployment checks. You will enter wages withholdings unemployment income Social Security benefits interest dividends and more in the income section so we can determine your 2021 tax bracket and calculate your adjusted gross income AGI. Heres what you need to know.

Effective January 5 2020 the Maximum Weekly Benefit Amount in the District of Columbia has increased from 432 to 444 for new initial claims. Enter your tax information to the best of your knowledge. In short yes unemployment income is taxed.

This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. Bidens legislation changes the rules for this year to ensure individual taxpayers who received federal unemployment benefits wont have to pay tax on the first 10200 they. 4 days ago.

To help taxpayers the IRS will take steps to automatically refund money in spring and summer 2021 to people who filed their tax return reporting unemployment compensation. On April 15 2021 the Office of Tax and Revenue OTR issued Tax Notice 2021-06 which explained the effect on District taxpayers of the unemployment compensation. And is based on the tax brackets of 2021.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. This sub-reddit is about news questions and well-reasoned. Im still waiting for my 2020 unemployment refund.

This Estimator is integrated with a W-4 Form. Up to 10 cash back 2021 Tax Refund Calculator Estimate your federal tax refund for free today. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file.

Basically you multiply the 10200 by 2 and then apply the rate. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular. This is available under View Tax Records then click the Get Transcript button and.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. It is mainly intended for residents of the US. However paying taxes on unemployment income and understanding how getting unemployment affects your tax return calls for a bit more.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployement Income. This way you can report. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Eligibility for unemployment insurance benefit amounts and the length of time benefits are available are determined by the State law under which unemployment insurance. You already filed a tax return and did not claim the unemployment exclusion.

All claimants who are. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. This handy online tax refund calculator provides a simplified version of the IRS Tax Form 1040.

I got my 2021 tax refund in like a week though lol. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. The IRS will determine the correct taxable amount of unemployment compensation and tax.

As you make progress the taxes you owe or the. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

To reiterate if two spouses. Another way is to check your tax transcript if you have an online account with the IRS. Start a New 2021 Tax Return.

By completing the appropriate information you can estimate what your refund will.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Tax Day And Extension Options Nextadvisor With Time

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Llc Tax Calculator Definitive Small Business Tax Estimator

California Paycheck Calculator Smartasset

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Simple Tax Calculator For 2021 Cloudtax

Income Tax Calculator 2021 2022 Estimate Return Refund

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Tax Calculator Estimate Your Taxes And Refund For Free

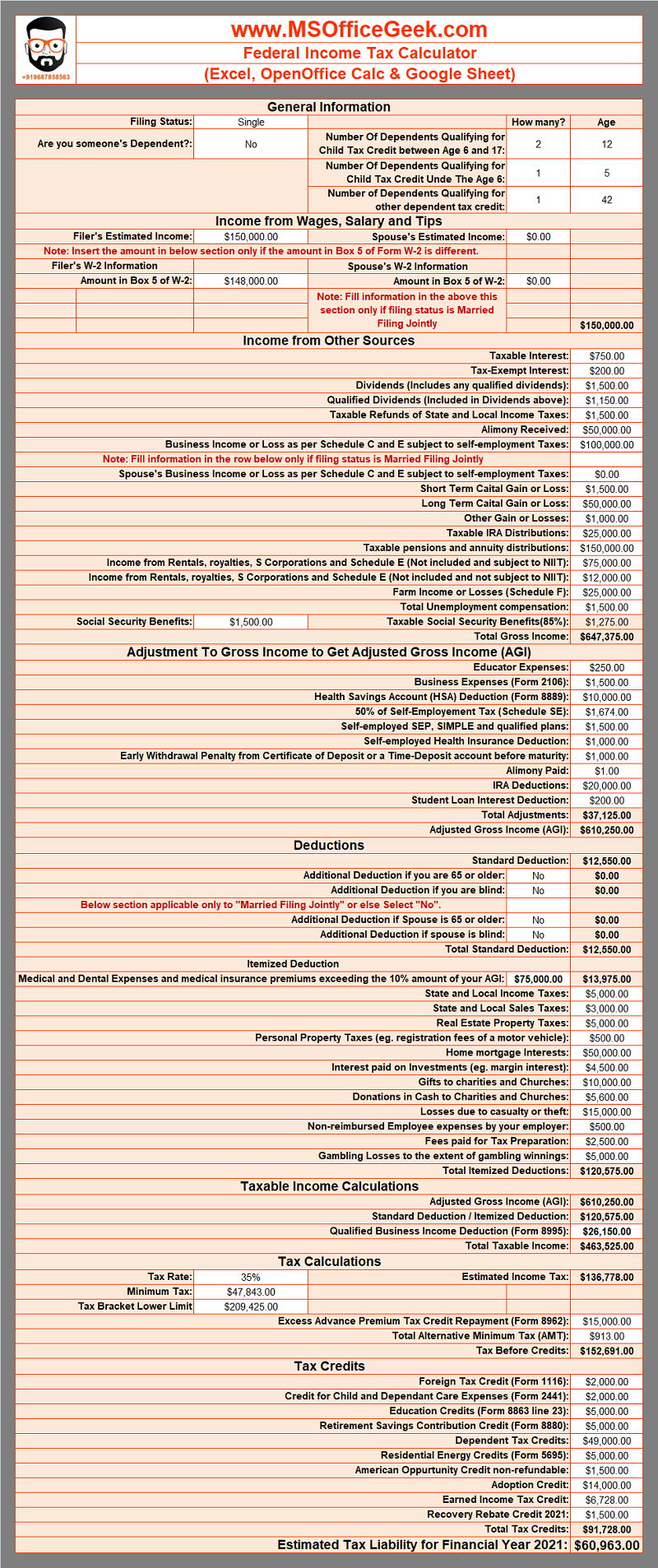

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

What Are Tax Calculators Turbotax Tax Tips Videos

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek